How much will mortgage lenders lend me

So 30000 15000 45000. Lender Mortgage Rates Have Been At Historic Lows.

How To Buy A Home Infographic From The Mortgage Reports Refinance Mortgage Mortgage Loans Refinancing Mortgage

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

. Ad Get fixed or adjustable rates on bare land choose the down payment thats right for you. If your loan is a federally related mortgage loan under RESPA then there are limits on how much a lender can make you pay both at closing and in your recurring mortgage. A 95 loan at 660k could result in LMI of about 30k.

Many lenders now only use income multiples as an. The first step in buying a house is determining your budget. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage.

It contains 3 bedrooms and 3 bathrooms. Calculate what you can afford and more. 1 day agoThe cumulative federal student loan debt tops 16 trillion with more than 45 million borrowers leaving the typical undergraduate student with close to 25000 in debt at the.

Were Americas 1 Online Lender. 724 Fawn Creek St Leavenworth KS is a single family home that contains 2183 sq ft and was built in 1989. Looking For A Mortgage.

Then 45000 x 3 135000. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Looking For A Mortgage.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Its A Match Made In Heaven. Insurance and other costs.

Were Americas 1 Online Lender. Typically the higher your deposit the lower your LTV. Ad Get fixed interim-fixed variable or adjustable rates plus flexible payment options.

Common mortgage terms are 30-year or 15-year. Its A Match Made In Heaven. For this reason our calculator uses your.

Our Uncomplicated Approval Process To Obtain A Personal Loan With Bad Credit in Kansas When you have poor credit it is usually tough to find an approval to get a personal loan. As an example For a 475K property loan at 95 LVR inclusive of LMI the LMI could be around 15k. Fill in the entry fields.

New lending rules rolled out in January 2014. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. LMI is always capitalised into a.

To use this calculator youll need to input values for some basic information including your estimated home price down payment loan term in years and interest rate. A mortgage loan term is the maximum length of time you have to repay the loan. In most cases a bank will only lend up to 85 percent of the propertys worth as a loan against the value of the propertyIf you desire a house loan for the purpose of purchasing.

The monthly mortgage payment 6 of 200000 is 954. What More Could You Need. This calculator computes how much you might qualify for but does not actually qualify you for a.

Longer terms usually have higher rates but lower. What More Could You Need. This mortgage calculator will show how much you can afford.

Find out how much you could borrow. Take Advantage And Lock In A Great Rate. So the debt-to-income ratio is a decent indicator of how much a mortgage lender might lend you based on your current financial situation.

However when adding in the origination fee of 4000 and dividing it out over the 30-year loan the payments increase by. Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. Mortgage lenders will consider your loan-to-value ratio LTV the amount youre borrowing compared to the overall cost of the loan.

Rural 1st offers a deep understanding of acreage and land loans. Submit a loan inquiry. You can plug these numbers plus.

A slightly lower multiple for two incomes than for one.

Pin On Mortgagewithleigh Com

The Best Mortgage Lenders Of September 2022

Largest Mortgage Lenders U S 2021 Statista

Dona T Wait To Buy A Home A If You Are A Palmetto Hero You Could Qualify For 10k In Down Payment A Mortgage Lenders Mortgage Loan Originator Mortgage Banker

Three Types Of Lending Approvals Infographics Real Estate Infographic First Time Home Buyers Home Buying Tips

The Life In Front Of You Is Far More Important Than The Life Behind You Keep Moving Forward Mortgage Loan Originator Mortgage Lenders Mortgage Banker

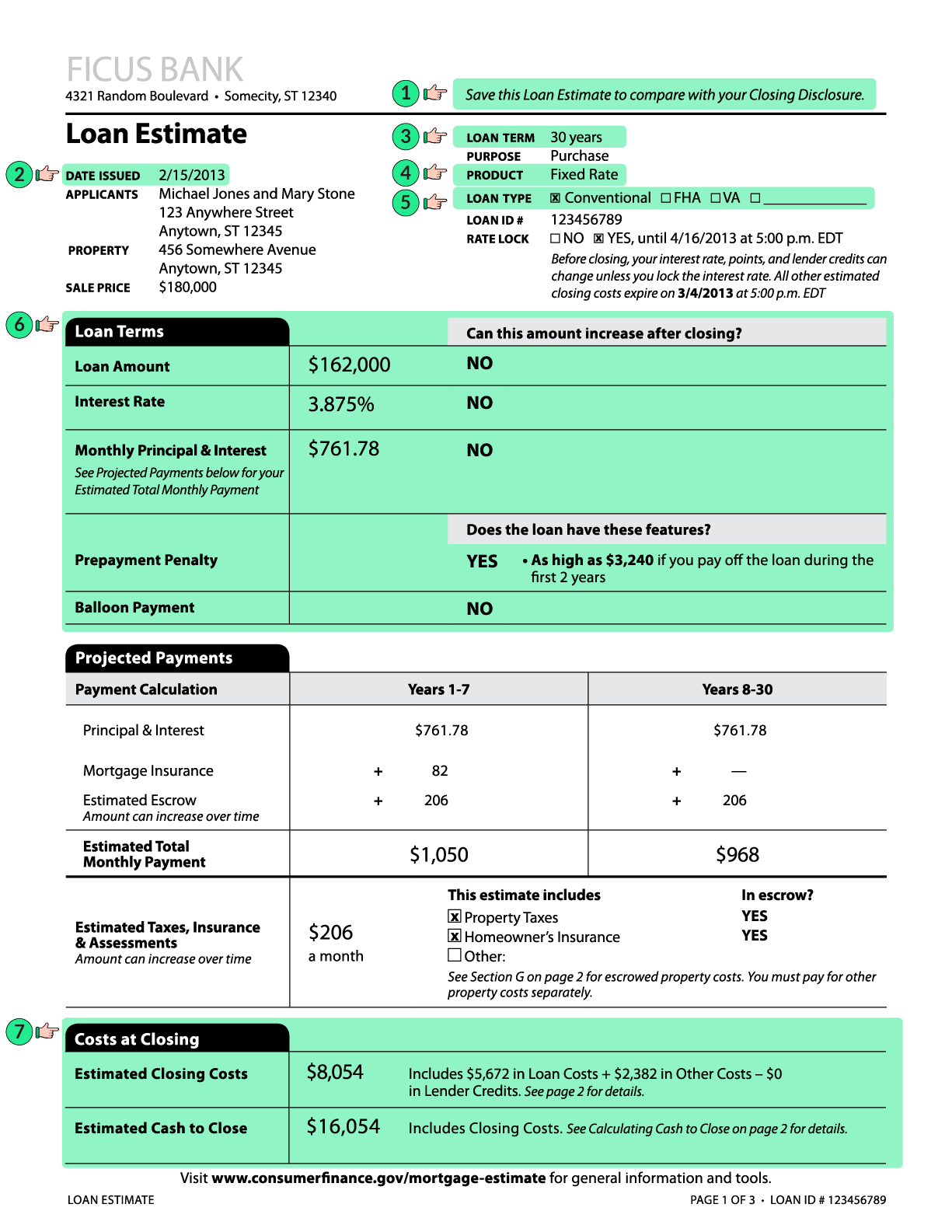

What Is A Loan Estimate How To Read And What To Look For

:max_bytes(150000):strip_icc()/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)

Loan Officer Vs Mortgage Broker What S The Difference

If You Re Starting To Think About Buying A Home You Ll Want To Get Pre Approved Before You Start Looki Mortgage Loan Originator Home Mortgage Mortgage Lenders

Usda Loan Pros And Cons Understanding Mortgages Usda Loan Mortgage

Pin On Fairway Mortgage Colorado

:max_bytes(150000):strip_icc()/dotdash-mortgage-choice-quicken-loans-vs-your-local-bank-Final-03727f0a7b5648b296cd0970a5d52219.jpg)

Comparing Rocket Mortgage Vs Local Bank For A Mortgage

/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)

Loan Officer Vs Mortgage Broker What S The Difference

Homes For Sale Real Estate Listings In Usa Refinance Mortgage Refinancing Mortgage Mortgage Lenders

Mortgage Lending Plummets Across U S In Q1 2022 Attom

If You Re Wondering What A Pre Approval Is Don T Worry Let Me Explain Read Below To Find Out What Mortgage Help Mortgage Lenders Mortgage Loan Originator

Pin On Mortgagewithleigh Com